when will the 8915 e tax form be available

Such a statement should look similar to the following for Form 8915-E or correspondingly similar for Form 7202. April 08 2021.

Solved Wil The Amount Of The 3 Year Covid Annuity Repayme Intuit Accountants Community

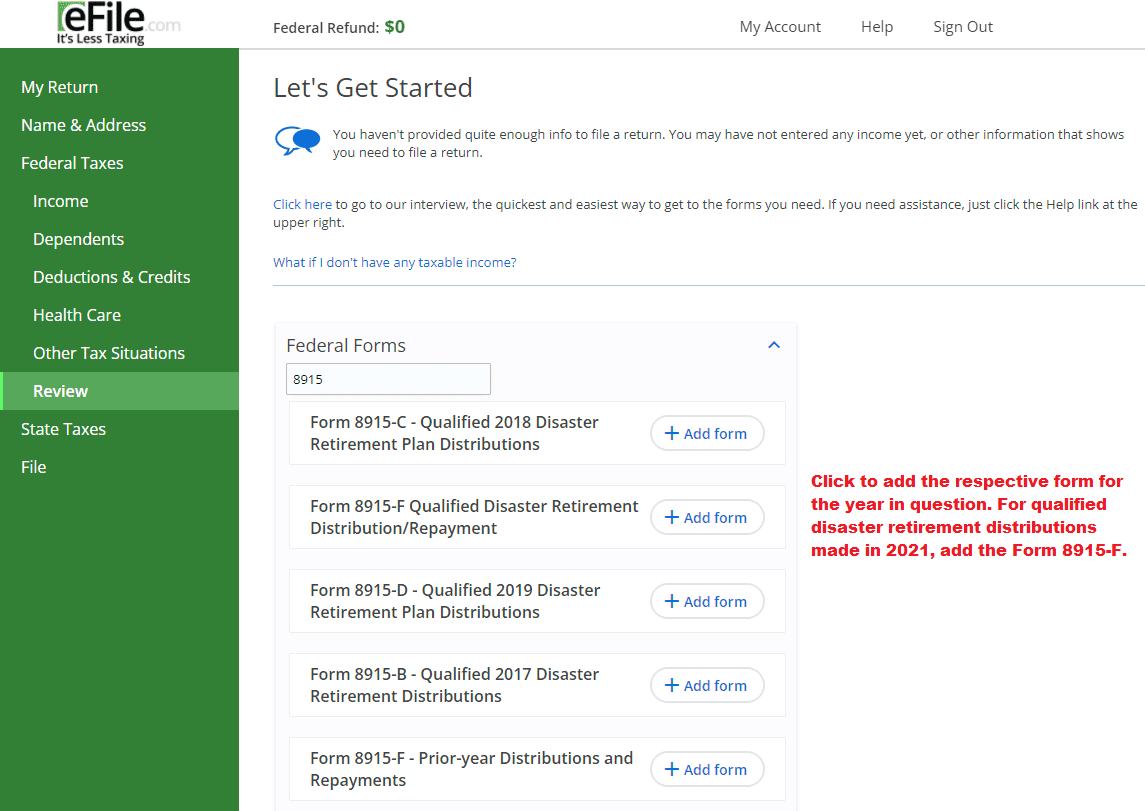

If you filed Form 8915-E in 2020 because you took a retirement distribution due to COVID-19 hardship then the IRS will require you to file a 8915-F this year.

. This form replaces Form 8915-E for tax years beginning after 2020. File 2021 Form 8915-C with your 2021 Form 1040 1040-SR or 1040-NR. From Simple to Advanced Income Taxes.

There is a box to check on the 1099-R entry worksheet but nothing happens when you check it other than it turns red. If married file a separate form for each spouse required to file 2020 Form 8915-E. This form replaces Form 8915-E for tax years beginning after 2020.

CSKcpa56 Yes were waiting for TurboTax to include form 8915-F and also update the step-by-step instructions so you can do this correctly. Attach to 2020 Form 1040 1040-SR or 1040-NR. In 2021 the form was available around February 26 2021.

Forms that have been typically filed as a PDF in the past such as Form 8915-E or other new forms not yet on XML should still be sent in as a PDF. Over 50 Million Tax Returns Filed. A distribution made December 31.

Click Retirement Plan Income in the Federal Quick Q. Form 8915-E was for reporting disaster distributions in 2020 only. The taxable amount will be removed from the 1099-R and placed on the 8915-E per IRS guidelines.

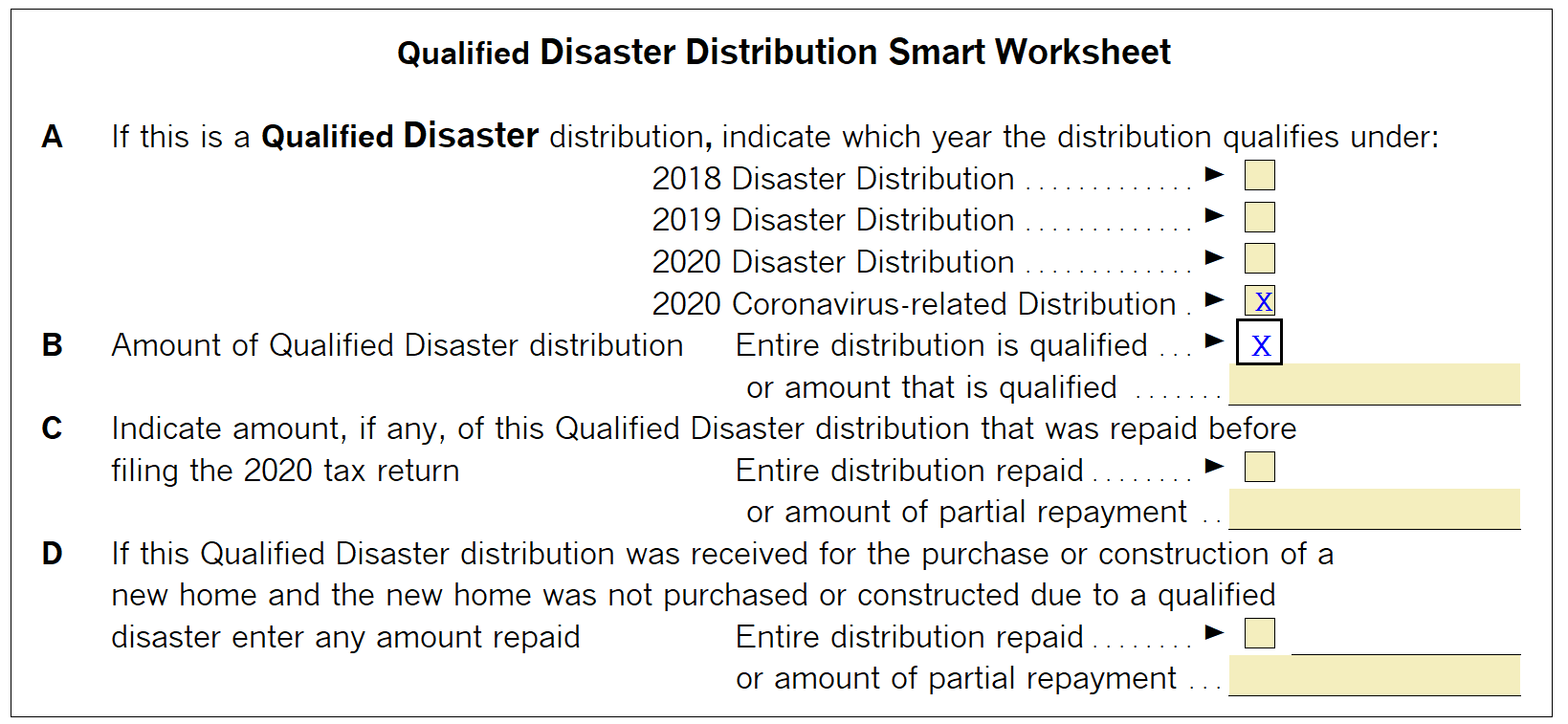

See Coronavirus-related distributions under Qualified 2020 Disaster Distribution Requirements later. I have a taxpayer with a covid qualifying early IRA distribution. When Will Form 8915-e Be Available For 2021.

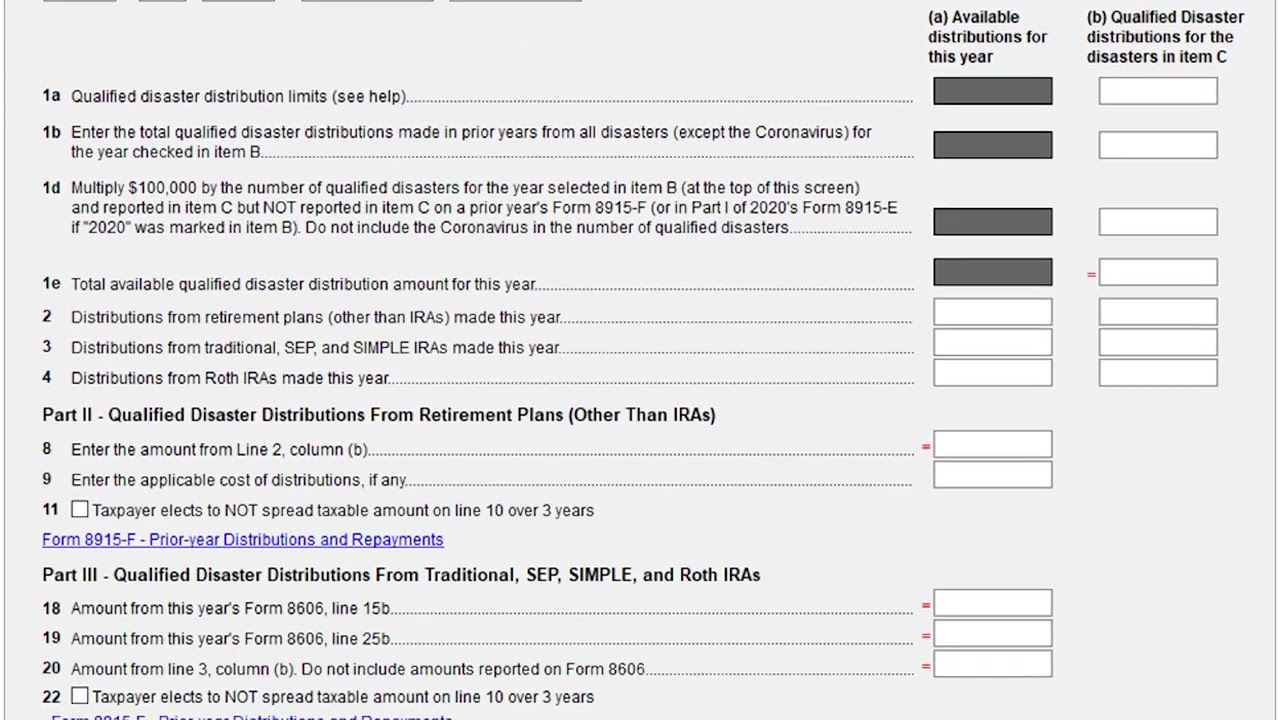

To enter or review Form 8915-E information. About Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments Use for Coronavirus-Related and Other Qualified 2020 Disaster Distributions Use Form 8915-E if you were adversely affected by a qualified 2020 disaster or impacted by the coronavirus and you received a distribution that qualifies for favorable tax treatment. I looked for the 8915-E form which I know I need to complete and there is nothing on Proseries for that Form.

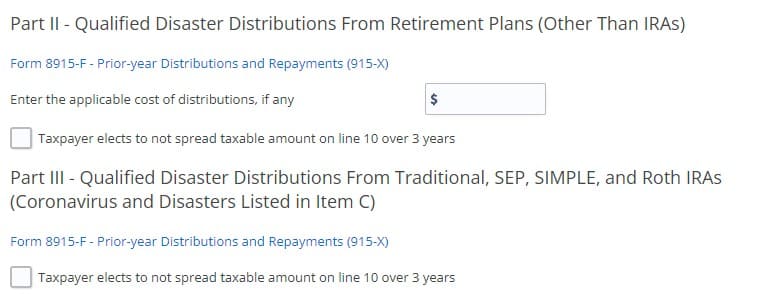

The program will carry your information to the 8915-E automatically. When will form 8915-E be update and available for 2021 tax year. This form will be used for anyone who chose to take a distribution from their retirement and spread the taxable amount over three years.

Recently many people have found their lives upside down out of work working less furloughed or experienced a natural disaster. Your social security number. Form 8915-E for retirement plans.

From within your TaxAct return Online or Desktop click FederalOn smaller devices click in the upper left-hand corner then click Federal. Column a of your Form 8915-F exceeds your total available qualified disaster distribution amount from line 1e of your Form 8915-F you may allocate the amount among the plans by any reasonable method when determining the amounts on lines 2 3 and 4 of column b. For those of us who took retirement distributions due to COVID-19 in 2020 and chose to pay taxes over 3 years form 8915-E should again be used for the 2021 tax year for the 2nd installment.

37509G distributions made in 2020 or qualified. The IRS does not support Form 8915-E as an e-fileable form. The form was initially launched in 2020 to meet the qualified disaster treatment of people who provide repayments on a three-year tax portion.

Click Taxpayer Qualified 2020 disaster retirement plan distributions and repayments Form 8915-E. It was recently approximately 10 days taken out of draft and finalized. The completed Form 8915-E will need to be added as a PDF attachment for e-file Level Up is a gaming function not a real life function.

When will form 8915-E be update and available for 2021 tax year. Quickly Prepare and File Your 2021 Tax Return. Fill in Your Address Only if You Are Filing This Form by Itself and Not With Your Tax Return.

If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before December 31 you may have coronavirus-related distributions eligible for special tax benefits on Form 8915-E. The IRS draft instructions which seem to still be the only ones that are available DO NOT say that Form 8915-F should not be used for tax returns filed in 2021 for taxpayers that took disaster distributions in 2020. TurboTax has an available date of March 24 2022.

If you are not required to file an income tax return but are required to file 2021 Form 8915-C fill in the address information on page 1 of Form 8915-C sign the Form 8915-C and send it to the IRS at the same time and place you would otherwise file 2021 Form 1040 1040-SR or 1040-NR. Reporting coronavirus-related and other distributions for qualified 2020 disasters made or received in 2020. When Should I Not Use a Form 8915-F.

If any certified individual is affected by any qualified disaster they can claim CRDs coronavirus-related disasters. Ad IRS-Approved E-File Provider. Congress enacted relief to ease the financial burden of those incurring disaster losses or have suffered financially due to the Coronavirus.

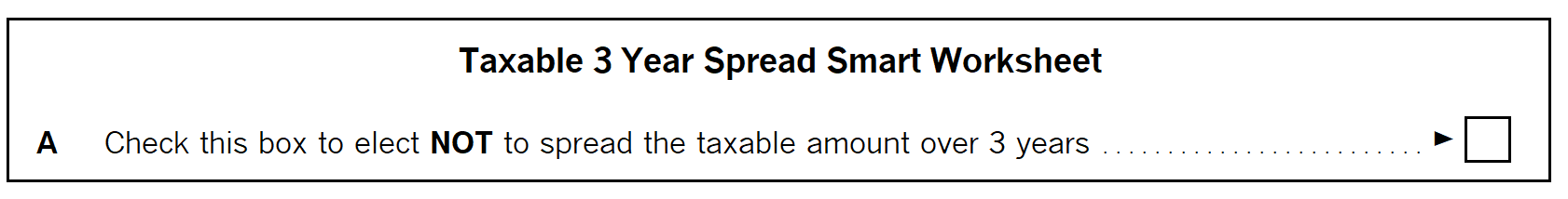

Please be aware that these instructions are only if you previously filed the 8915-E on your 2020 return. If you took a distribution in 2020 and elected to report it over three years you will need Form 8915-F to report the second year distribution on your 2021 return. If do not want to spread the distribution over a 3 year period you will need to check the box next to Elect NOT to spread the taxable amount over 3 years Please Note.

When will form 8915-E be update and available for 2021 tax year. When will form 8915-E be update and available for 2021 tax year. In fact the instructions and Form 8915-F clearly say that the new Form should be filed in 2021 for.

Do not use a Form 8915-F to report qualified 2020 disaster Feb 11 2022 Cat. The IRS created new Form 8915-F to replace Form 8915-E. When and Where To File.

Theyre not committing to enable this until 331 but were hoping sooner. Use Form 8915-A or 8915-B if you were adversely affected by a 2016 or 2017 disaster and you received a distribution that qualifies for favorable tax treatment. You will create this form 8915-F in the program under the.

FORM 8915-E availability.

Generating Form 8915 In Proseries

Coronavirus Related Distributions Via Form 8915

Form 8915 E For Retirement Plans H R Block

Cares Act Retirement Distributions Reporting Form 8915 F 2021 From 2020 Irs Form 8915 E Youtube

Generating Form 8915 In Proseries

When Will Form 8915 E 2020 Be Available In Turbo T Page 19

Coronavirus Related Distributions Via Form 8915

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915 E Explained Youtube

Solved Wil The Amount Of The 3 Year Covid Annuity Repayme Intuit Accountants Community

Solved Form 8915 E Is Available Today From Irs When Will Page 2

When Will Form 8915 E 2020 Be Available In Turbo T Page 19

8915 F 2020 Coronavirus Distributions For 2021 Tax Returns Youtube

Solved Irs Form 8915 E Intuit Accountants Community

Why Is 8915e Form Not Appearing For Me On Turbo Ta

When Will Form 8915 E 2020 Be Available In Turbo T Page 20

Solved Form 8915 E Is Available Today From Irs When Will Page 2

Retirement Tax Services Form 8915 E If Your Clients Had 2020 Taxable Distributions Learn Asap Meta Http Equiv Content Security Policy Content Script Src None